What Are Your Senior Health Coverage Options?

Are you approaching age 65 or getting close to qualifying for Medicare? If so, you might be exploring health insurance choices designed for seniors. There are several ways to enhance or supplement your Original Medicare benefits for more complete protection.

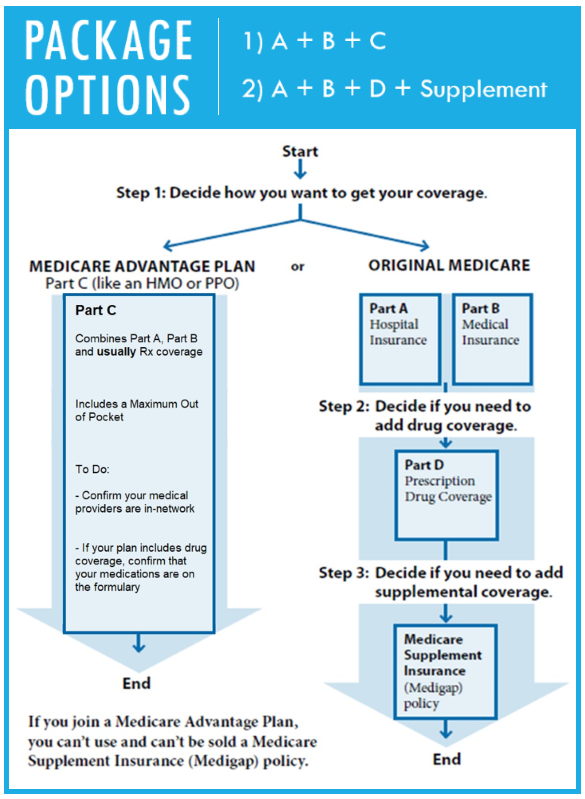

Medicare Advantage Plans

Medicare Advantage Plans—often called “MA Plans” or “Part C”—are provided by private insurance companies approved by Medicare. These plans may include:

- Preferred Provider Organizations (PPO)

- Special Needs Plans (SNP)

- Private Fee-for-Service Plans (PFFS)

- Medicare Medical Savings Account Plans (MSA)

- Health Maintenance Organizations (HMO)

When you join a Medicare Advantage Plan, your Medicare-covered services are managed by the private insurer instead of Original Medicare. Many of these plans also include prescription drug coverage and extra benefits like vision or dental care. Plan options can vary by county, so you’ll find different choices depending on your location within the United States.

Prescription Drug Coverage (Part D)

Medicare Part D adds prescription benefits to Original Medicare, helping pay for medicines, many vaccines, select biologics, and certain supplies not covered under Parts A or B. Even if you don’t take medications today, enrolling can protect future needs and help you avoid late-enrollment penalties down the road.

Eligibility and Requirements

You generally qualify for Medicare if one or more of the following apply:

- You’re 65 or older.

- You’re under 65 with a qualifying disability or End-Stage Renal Disease (ESRD).

- You or your spouse have at least 40 work quarters (about 10 years) of Medicare-covered employment.

- You’re a U.S. citizen or a lawful permanent resident.

Enrollment

Your Initial Enrollment Period (IEP) typically lasts seven months—the three months before your 65th birthday, your birth month, and the three months after. Enroll during the IEP to start benefits as soon as you’re eligible and to avoid penalties.

If you miss your IEP, the General Enrollment Period runs from January 1 to March 31, with coverage usually starting mid-year and potential penalties applying. If you had qualifying employer coverage, you may get a Special Enrollment Period that can extend up to eight months after that coverage ends.

You can sign up online via the Social Security website, visit a local office, or call their official line. (If you’re drafting a demo page, use a placeholder like 800-555-0123 and replace it later with the official number.)

Still Have Questions About Medicare Plans?

We figured you might! That’s why we partner with trusted Medicare specialists—so you can rely on the same support we do.

Choosing a Senior Health Insurance plan can feel overwhelming with so many options and providers. Our goal is to make the process simple, transparent, and fast—so you can find a plan that truly fits your health needs and budget.

We’ve been helping Medicare-eligible Americans for over 12 years, offering free guidance and personalized plan comparisons. As an independent brokerage, our mission is to explain your Medicare choices clearly and make sure every question gets answered before you enroll.

For live assistance, call 1-800-555-2746 or click here to schedule your free consultation.

Individual

The American Health Exchange serves as the nation’s trusted marketplace where individuals, families, and small businesses can explore affordable, high-quality government-backed health coverage options across the United States.

Learn More

Medicare

The American Health Exchange is the country’s official online marketplace where individuals, families, and small businesses can access reliable, affordable, and high-quality government-supported health coverage nationwide.

Learn More

Travel insurance

The American Health Exchange is the official national marketplace where individuals, families, and small businesses can discover comprehensive, affordable, and government-backed health insurance plans across the United States.

Learn More

Medi-Cal

The American Health Exchange serves as the United States’ official marketplace, helping individuals, families, and small businesses access dependable, affordable, and high-quality government-sponsored health coverage options nationwide.

Learn More